No Third-Party Beneficiaries

Blockchain-based P2P crypto lending platforms use smart contracts to execute the deal between the borrower and lender without the need of any third-party. They easily interact with a blockchain network securely.

At Crypsol Technology, we offer top-tier P2P crypto lending platform development services at highly competitive prices.

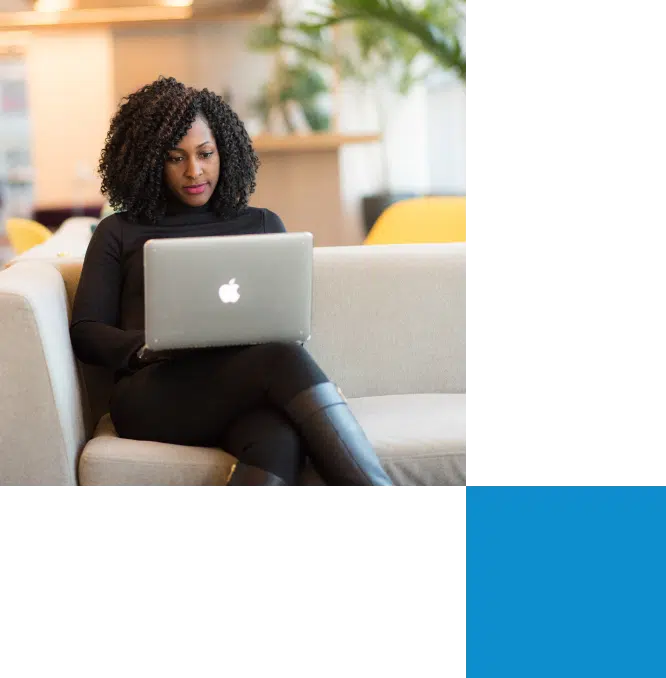

The practice of lending and borrowing is as old as the invention of money. It still exists and will continue to do so in the future. The concept of funding has evolved significantly over the years, and now, with the help of technology, one can get funds within a few clicks. Blockchain is one such technology powerhouse that is transforming finance infrastructure across the globe.

In a recent addition to the system, blockchain-based Peer-to-Peer (P2P) lending software allows two parties to satisfy their particular financial needs without any third-party at a reduced cost. It will grow up to be a highly-secured and hassle-free lending system of the future. Take advantage of blockchain technology and launch your P2P lending software with the help of our experts.

Crypsol Technology offers cutting-edge tools to help you launch a peer-to-peer crypto lending platform built for growth, transparency, and security.

We develop efficient and scalable fiat-based P2P lending platforms, combining traditional finance structure with blockchain-backed trust and automation.

Crypsol’s cross lending platforms bridge fiat and crypto, creating a hybrid solution ideal for markets still transitioning to full digital asset adoption.

Peer-to-peer (P2P) lending is a modern alternative to traditional banking systems, enabling individuals to lend and borrow directly from one another. By removing intermediaries such as banks, underwriters, and loan officers, P2P platforms offer a faster, more cost-effective solution for accessing credit.

Through smart contracts and blockchain technology, Crypsol Technology ensures secure and transparent lending processes. Lenders benefit from potentially higher returns compared to traditional savings, while borrowers — especially those with limited credit history — gain quicker access to financing.

Blockchain-based P2P crypto lending platforms use smart contracts to execute the deal between the borrower and lender without the need of any third-party. They easily interact with a blockchain network securely.

The whole process of lending is taken care of based on the predefined guidelines with the help of smart contracts without any human intervention. This guarantees that the process runs smoothly and eliminates possible errors. So, the P2P platform provides high security and trust to its users.

Blockchain enables the lender to remain anonymous without revealing one’s identity other than the initial platform registration. A lender can select the loan type from the marketplace that he/she prefers to offer and conduct the process from the wallet.

The loan origination is the complete process from applying for the loan by the borrower to the lender’s disbursal of funds. Our lending platform development will let the platform assist in the origination process via the Peer-to-Peer lending system.

The loan calculator will help to determine the Equated Monthly Installment (EMI) repayment amount, the interest cost, deferred payment loans, etc. This helps the borrower and lender be clear with what they have agreed to payback and receive, respectively.

In the current system, the credit score of an individual defines the trustworthiness of a person’s financial commitment and repayable capacity. This will help the investor or lender to decide on the borrower.

We enabled the P2P cryptocurrency lending platform with an updated security system with SSL certification and two-factor authentication to provide safe and secure login with encryption.

Refinancing is one of the good features for a borrower who has already paid half of the repayment amount within the said period. This feature allows a borrower to get access to a new loan from another lender to refinance himself.

Location-based Know Your Customer (KYC), and Anti-Money Laundering (AML) verification processes confirm users’ identities and are used when the withdrawal of cryptocurrencies is equivalent to a specific amount and above.

A secured and smart-contract driven contractual escrow system automates the locking and releasing of users crypto assets for instant and third-party transactions.

The hot wallet enabled P2P lending blockchain will allow both the buyer and seller to hold, send, receive a spectrum of cryptocurrency as per your transaction in a secure manner.

Loan Valuation Ratio is the percentage of collateral value that you’re borrowing. LVR calculator will help the lender to access the loan application. This benefits both the borrower and the lender to make an informed decision before applying for it.

The lender management system helps in sourcing the potential borrower with the person’s detailed application like amount required, loan tenure, KYC, CIBIL score, etc. Lenders will get the borrower profiles as recommendations based on one’s capacity of lending.

All the registered borrowers and lenders can have a dashboard in the P2P lending platform, but both lenders and borrowers dashboard differs in the data they carry. For example, the lender’s dashboard will have information about the total amount transferred to the borrowers as a whole. For any particular person, balance in the wallet, complete repayment stats of the specific person, and the overall payment received.

Borrower Management enables him/her to submit a detailed application with all the required documents, information to be eligible for availing loans. In this way, the borrower can get notified by the lender who is ready to provide funds without any procedural hiccups.

Our data encryption policy protects users’ credentials and safeguards all the sensitive information stored in the database.

JSON Web token with RSA encryption to protect the data against the platform manipulation.

Anti-distributed denial of service protection from attacks in an attempt to make a machine or network unavailable for potential users.

Safeguard the platform from malicious inputs submitted by the attackers.

This protects from illegal access to users’ accounts without proper authorization.

Server-Side Request Forgery (SSRF) attack wherein the users create or control requests from vulnerable servers.

Prevents the HTTP request of retrieving and accessing hidden information in the network

A registered user can have access to a single login to the platform to ensure the user accesses this account with security and also keep a check on multiple user logins the same story.

Anti-denial service protects the platform from a large number of requests to the server from the attackers and makes sure the platform is available for intended users.

Every lender who is willing to lend funds to the potential borrower must create a lender’s profile with the following information to proceed further:

Like a lender, a borrower has to create a profile in the Peer-to-Peer lending platform with the following details:

The borrower can send loan requests to all the lenders in the network and let them know about it along with your profile information. The smart contract will enable this process.

After the successful creation of the lender’s profile, the lender will start to get feed about potential borrowers. The lender can go through their profile and schedule a call with the borrower.

The matching engine in the platform will set to find the relevant profile and helps to choose the potential borrower and lenders to close the deal. This ensures a secured P2P lending experience that is beneficial to both parties.

Once the lender selects the profile, he can schedule a call or meeting with the borrower to understand the borrower and his/her purpose of borrowing the amount.

Based on the creditworthiness of the borrower and lending interest of the investor, a smart contract fixes the loan interest rate. The smart contract also helps categorize the borrower as high-risk, medium-risk, and low-risk borrowers based on their repayment rates.

After the successful completion of the process, as mentioned above, the lender can send the loan directly from his wallet. Now, the borrower is liable to pay back the loan amount with the interest rate.

Based on the agreed terms, the borrower can repay the loan amount as a monthly or quarterly installment using a smart contract embedded in the wallet. If the borrower doesn’t pay the loan amount, the smart contract deducts the penalty amount. Failure to repay the loan will lead to selling the collaterals in the market.

Building a peer-to-peer lending platform goes far beyond just development — it requires strategic planning, precise execution, and deep domain expertise. At Crypsol Technology, we prioritize understanding your unique requirements and delivering tailored blockchain-powered solutions that ensure your platform’s success and scalability in the competitive market.

At Crypsol Technology, your platform is built by blockchain experts with proven experience and deep technical know-how. Our team conducts in-depth research, evaluates every crucial factor, and stays in constant communication to fully understand your business needs. We ensure the final product aligns perfectly with your goals — all while giving you a smooth, stress-free development experience so you can focus on scaling your brand and core operations.

Turn your ideas into reality with our expertise in web3 and AI technology! Reach out to us today and discuss your project or ask your queries to our proficient web3 or AI experts.